A modest proposal on affordabilty

Dispensing with some of the more dumb ideas

Home affordability is one of the most politically potent issues right now, and there is bipartisan support for all sorts of daffy ideas to deal with it. On the right, you have Trump’s proposal to have Fan and Fred buy up mortgage backed securities (a la QE), or allow people to use 401ks or 529 plans for a down payment. On the left, you have advocates for rent control or even government expropriation for disfavored landlords. There is a bipartisan “solution'“ as well, which is to prevent institutional investors like Blackrock from owning single family homes. All of these are band-aids which won’t do anything to help affordability.

The main cause of the current affordability crisis is that Jerome Powell treated a temporary COVID-induced recession the same way Ben Bernanke treated a burst residential real estate bubble. He cut interest rates to zero and directed the Fed to buy trillions of dollars worth of mortgage backed securities. The Federal Government printed a massive amount of dollars in order to support people who temporarily lost their jobs. We saw goods and services inflation as a result - too much money chasing too few goods. We also saw real estate prices spike - too much money chasing too few assets.

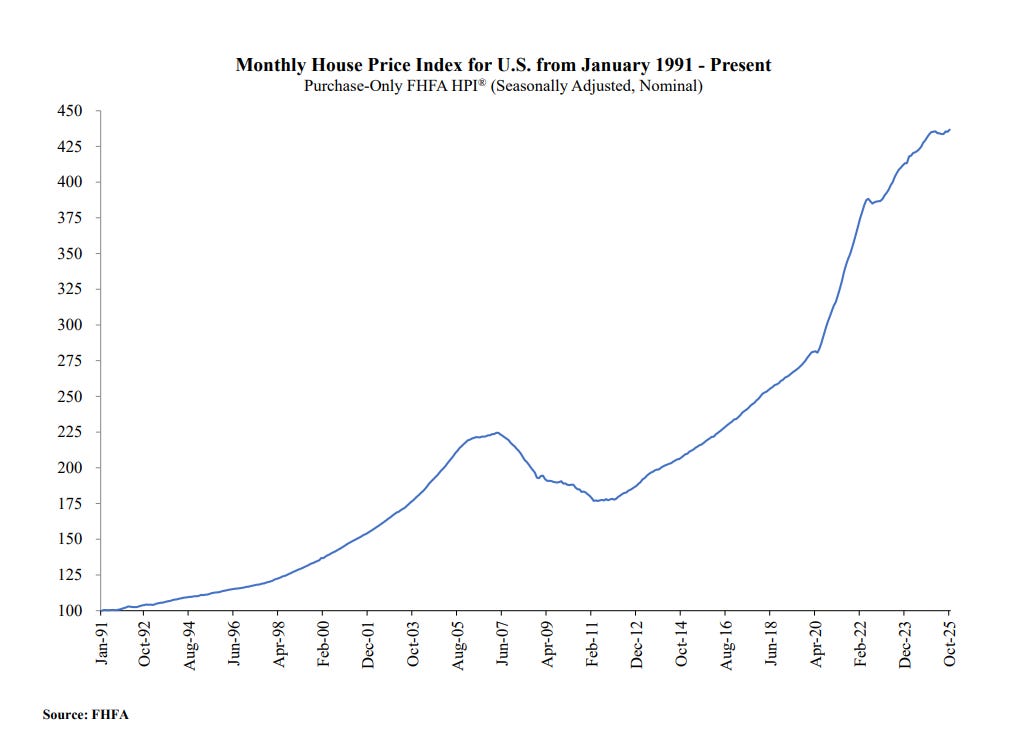

You can see in the chart below the acceleration in home prices beginning with COVID.

While home prices are leveling off, we are a long way from homeownership being affordable, especially for the first time homebuyer. How can we fix that?

As any car dealer will tell you, people don’t care about the sticker price - they care about the monthly payment. So what can policymakers do to ease the burden for the FHTB without driving up real estate prices in general? Let’s dispense with some of the bad proposed ideas first:

50 year mortgage: Car dealers have been extending the term for car loans in order to make autos more affordable. Trump has floated the idea of a 50 year mortgage in order to do the same thing. A 50 year mortgage would lower the monthly payment modestly (about 12%) which could help, but isn’t going to make a massive difference. If the 50 year mortgage backed security trades at a higher yield than the 30 year, then it makes even less of a difference.

Institutional Ownership: Yes, some institutions buy single family homes for rentals. The most obvious name is Blackrock, but there are single family REITs like American Homes 4 Rent and Invitation Homes. American Homes 4 Rent owns 61,692 properties while Invitation owns 86,139. Given that there are between 82 and 85 million single family homes in the US, their portfolios are small. Purchase activity for these firms per year is around 5,000, which compares to existing home sales by NAR of 4.4 million or so last year. Institutions are not influencing the real estate market, and banning them is a feel-good measure that gives the appearance of doing something.

Re-instituting QE: Trump has suggested that FHFA direct Fan and Fred to buy $200 billion worth of MBS to push down rates. It did have a marginal effect, improving mortgage rates by 10 basis points or so. The problem is that it is temporary, and doesn’t move the needle for the first time homebuyer.

Rent control: Great if you are senior citizen living in a rent-controlled apartment you got 30 years ago. Sucks if you are a young adult who has to pay market rent on a smaller supply of market-rent apartments. NYC Mayor Mandami’s affordability czar believes in government control of housing, and that is a sure way to make lenders petrified of giving mortgages in her area of jurisdiction.

Any push for affordability has to hit the people most affected: the young adults who want to get their foot on the property ladder. So any lever has to help them, not the real estate market in general.

I need to provide a little background on how mortgage rates are set. Mortgage backed securities issued by Fan and Fred set basic levels for the entire industry. When the Fed did quantitative easing, they bought mortgage backed securities which pushed down rates for the industry in general. Every borrower benefited.

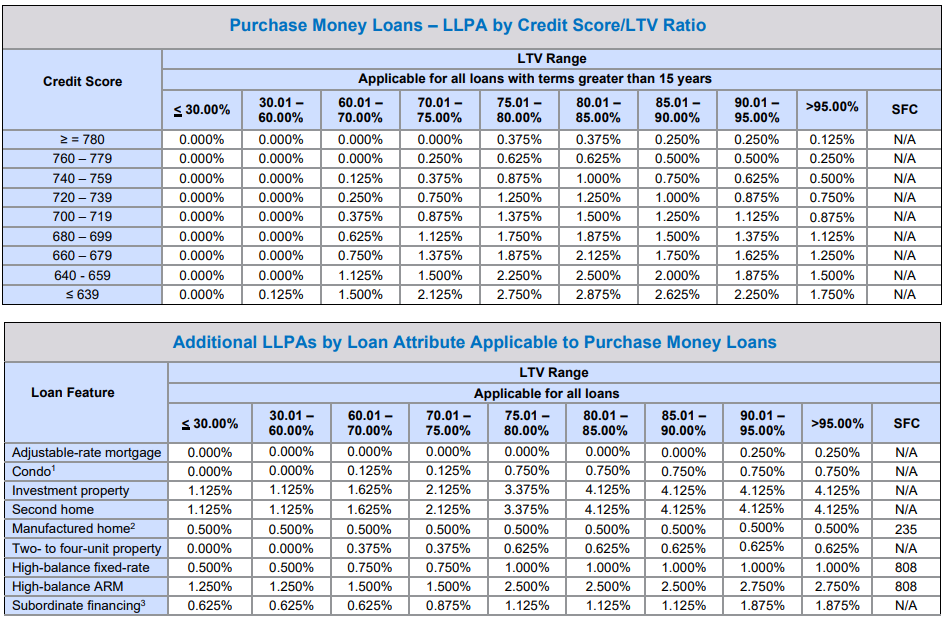

However, not everybody pays the same rate. People with good credit pay less, people who put down a tiny downpayment pay more. People who are borrowing for an investment property pay more than someone buying a primary home. These are controlled via loan-level pricing adjustments (LLPAs). Fannie and Freddie have a bunch of them, and here is a typical one:

These percentages in the matrix are addition points you have to pay on your mortgage when you take one out. They increase from top left to bottom right. In other words, a borrower with a 600 FICO score who puts up under a 7% down payment pays 2.25 points more than someone with a 800 score who puts up half.

Here are additional LLPAs that Fan and Fred use:

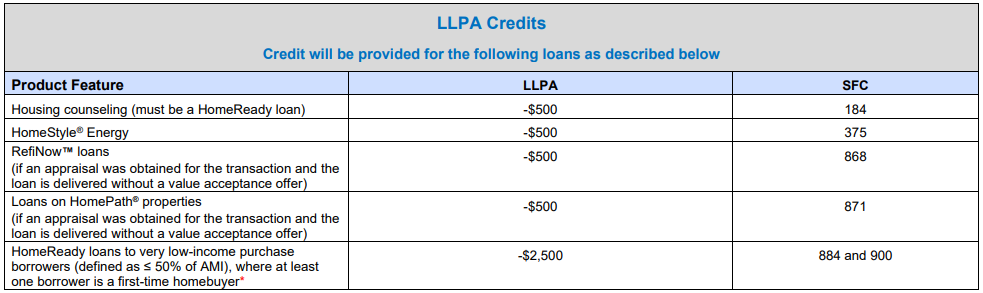

These are credits for things like solar panels, and they do have a first time homebuyer credit for low down payment homes when the borrower’s income is under 50% of the area median income. That is the one at the bottom.

If the government wants to attack the affordability issue for the first time homebuyer, it has to attack that final LLPA (the one for $2,500). First of all, it is so restrictive it is almost meaningless. The median income in the US is something like $83,000 and there are very few people making half of that who are buying homes. So it is largely window dressing.

The LLPA should be something meaningful (like 2 or 3 points without any sort of income cap) in order to help the first time homebuyer. This would meaningfully lower mortgage rates for the first time homebuyer while leaving the rest of the market untouched. This would help prevent real estate prices from spiking in response.

Fan and Fred / FHA could go one step further, and do what the VA does: allow people to roll the funding fee into the loan amount, which means they can pay a fee up front and won’t need to pay periodic mortgage insurance, thus lowering the monthly payment.

Any of these LLPAs could be offset with higher LLPAs for investment properties / second homes. Fan and Fed are flush with cash, as is the FHA insurance fund. The effect on the tax payer would be de minimus. And it would go a long way towards improving affordability for the demographic that really drew the short straw in the real estate market.

The LLPA aproach is way more practical than these flashy proposals everyone keeps floating. Targeting first-time buyers directly without juicing the whole market makes actual sense, and probly has better odds of getting through Congress than expropriation fantasies. I've watched friends stuck in this exact trap for years now, and it's brutal seeing them priced out while politicians debate 50-year mortgages.