The comic relief last week was the much ballyhooed release of Google’s AI platform Gemini. AI has been the theme of the stock market the past few months, and the indices have relied heavily on stocks like Google and Nvidia to hold things up. The breadth of the markets has been relatively narrow, which means that a lot of stocks are languishing while a few darlings get all the attention.

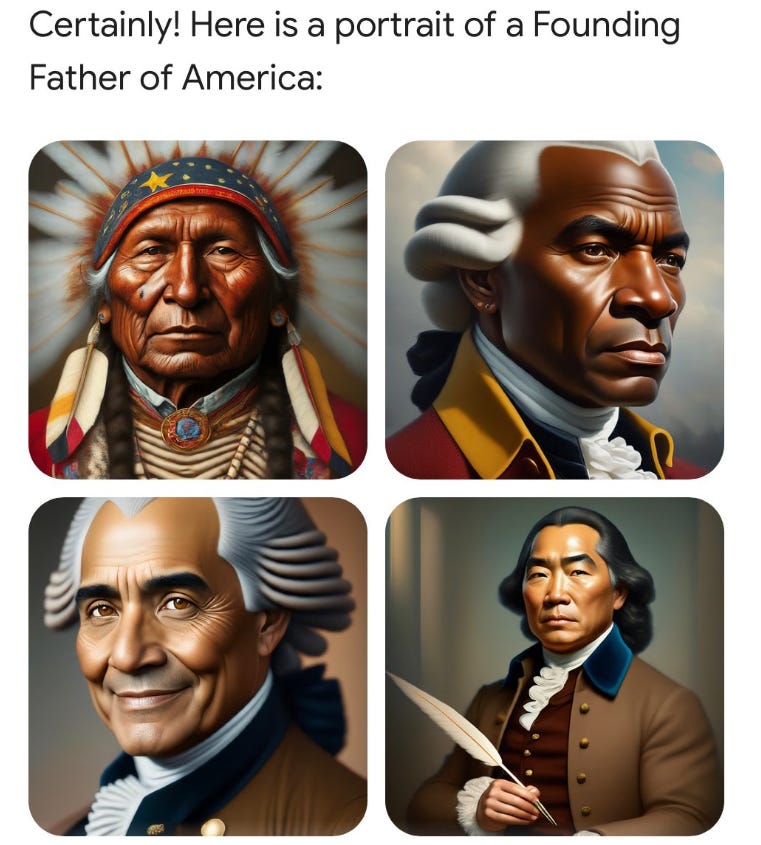

Google’s launch of Gemini caused quite a few snickers as it confirmed many of the worst suspicions of the company’s political viewpoints. The company’s programmers leaned heavily into DEI, which showed depictions of the Founding Fathers as Black, Asian and Native dudes.

It turned into a game, where people would try to get Gemini to show a picture of a white dude and Gemini couldn’t do it. Embarrassed at being a punchline, Google hastily shut down the images section, however more reporting showed that Gemini has some problems with the truth, especially when it comes to people and political ideology. Gemini also comes off as some sort Woke Hall Monitor in that it tosses in moral and ethical advice it was never asked for.

The problem isn’t just confined to AI images, as it punted on ethical dilemmas such as “who was worse for society? Elon Musk or Pol Pot?” as of eliminating Vijaya Gadde’s job is comparable to the Killing Fields. Gemini was also ambivalent over the ethical quandary of the bigger threat: nuclear holocaust or misgendering Caitlyn Jenner. All of this is great fodder for memes, but the bigger issue, of course is if this is how Google handles images, how does it handle internet search? Now that the cat is out of the bag, more and more stories are being written about the culture of Google and how the company had become sclerotic and rested on its laurels, happy to tell people not what they want to to know, but what Google thinks they should want to know.

Google stock was hit on the news, which shouldn’t have been a surprise. The problem of course is that if AI needs to be fact-checked, then its value as a productivity-enhancing tool is going to be limited. If it requires adult supervision, and sometimes gets stuff wrong then at some point AI will have a brain fart that costs people a lot of money. And once that happens, the lawyers will take over, and suck the life out of the company the way they did with IBM and AT&T in the 1980s.

The point is that while AI is not going anywhere, the hype may have gotten the upper hand, and once the hype balloon begins to deflate, earnings become valued less and less. The Nvidia of 2000 was Cisco Systems, a manufacturer of telecommunications equipment which was experiencing an explosion of orders as the Internet grew. In early 2000, Cisco was the poster child of the mantra: “Just buy good companies and everything will work out fine.” The fundamental story was sound, and momentum investors loved the stock. On the face of it, that isn’t bad advice, however the price you pay for a company does matter.

Unfortunately for Cisco Systems, while the fundamentals remained sound, the hype faded along with the Y2K hysteria. Cisco lost some 80% of its value in the year immediately after peaking in March of 2000. I wouldn’t be surprised to see the same fate hit Google and Nvidia, especially after Google’s Gemini proved that AI isn’t really ready for prime time yet.

Am I suggesting that Nvidia and Google are short candidates? Not at all. Shorting market darlings is the fastest way to the poorhouse this side of lottery tickets. That said, when they do crack, value investors are probably not going to be all that eager to catch the falling knife.

It isn’t enough to buy good assets; a good asset bought at a bad price is a lousy trade, and a crappy asset bought at a good price can be a good trade.

"In early 2020, Cisco was the poster child of the mantra: “Just buy good companies and everything will work out fine.” "

Did you mean 2020 or 2000?