Morning Report: Markets shrug off more tariff noise

Vital Statistics:

Stocks are higher this morning despite trade tensions. Bonds and MBS are down small.

We have a $39 billion 10-year auction this afternoon, along with the Fed minutes at 2:00 pm. We could see some movement in rates surrounding these events.

Donald Trump is threatening to impose 50% tariffs on copper and a potential 200% tariff on pharmaceuticals if several countries don't agree to a deal. "We will be releasing a minimum of 7 Countries having to do with trade, tomorrow morning, with an additional number of Countries being released in the afternoon," he posted on Truth Social late Tuesday. That said, these tariffs won't go into effect for a year, in order to give companies time to re-shore their businesses in the US. Copper futures soared on the news, however they are giving back some of these gains.

The tariffs on Japan and South Korea won't be as impactful as feared since they exempt electronics. Overall, market sentiment seems to be taking the issue in stride, and is confident that some sort of deal will be reached.

Of course this isn't going to be great for the mortgage and real estate market since it gives the Fed the excuse to maintain an inappropriately tight monetary policy given the current economic numbers.

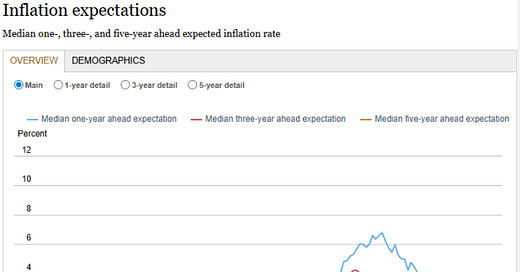

Inflationary expectations remain well-anchored, according to the New York Fed's Survey of Consumer Expectations. The one-year ahead estimate fell 0.2% to 3%, while the 3 year estimate was unchanged at 3%. The 5 year remained at 2.6%. If you look at a long-term graph, we are pretty close to historical averages:

When the Fed talks about "inflationary expectations remaining well-anchored" the above graph is what they are talking about.

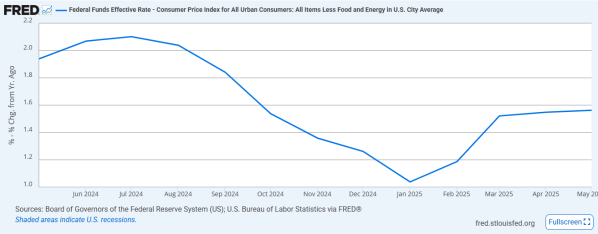

Lost in all of the current inflation discussion is that the real Fed Funds rate has been increasing since Trump took office. This is because the Fed Funds rate has been static, while inflation has fallen. The chart below shows that the real Fed Funds rate (FF effective rate minus core CPI) has risen from 1.04% to 1.56% since January.

Mortgage applications rose 9.4% last week as purchases and refis rose by the same amount. Last week included an adjustment for the 4th of July. “Mortgage rates moved lower last week, with the 30-year fixed rate decreasing to 6.77 percent, its lowest level in three months. After adjusting for the July 4th holiday, purchase applications increased to the highest level of activity since February 2023 and remained above year-ago levels,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Homebuyer demand is being fueled by increasing housing inventory and moderating home-price growth. The average loan size on a purchase application, at $432,600, was at its lowest since January 2025. The refinance index also increased over the week, with VA refinances in particular up 32 percent.”