Problems are coming to a head in commercial real estate

On Friday after the market closed, Moody’s changed its outlook on the US economy from stable to negative. This will probably have reverberations in the bond market on Monday, however markets have been expecting this change.

We had a lousy 30 year bond auction last week, which pushed up bond yields from the 4.5% level. Foreign demand is absent as China continues to sell off its Treasury portfolio. At some point that will reverse as China’s economy dips into recession and is forced to export its way out. In addition to the lousy auction, Jerome Powell said the Fed wasn’t confident that financial conditions are tight enough to bring down inflation. These two things pushed up the 10 year yield from below 4.5% to 4.64%.

Despite the rosy 4.9% Q3 GDP print, there are numerous indications that the economy is slowing. The ISM surveys have shown that the manufacturing sector is contracting, while the services sector is expanding at a modest pace. Weaker demand is driving the contraction, along with production indicators. Manufacturers are focused on cutting costs.

Another indication of potential weakness is the drop in commercial bank credit. Aside from the Great Recession, bank credit growth has generally remained positive. I suspect a big driver of the contraction is simply that many projects made financial sense when rates were at zero, but don’t make sense now.

We do know that commercial real estate is struggling, particularly office, but retail is having issues as well. JLL estimates that office properties in New York City alone have lost $76 billion in value. Another study sees commercial real estate values in San Francisco falling 40% - 45%. The problem for the banks is that the cost of financing these properties is increasing while asset prices are falling.

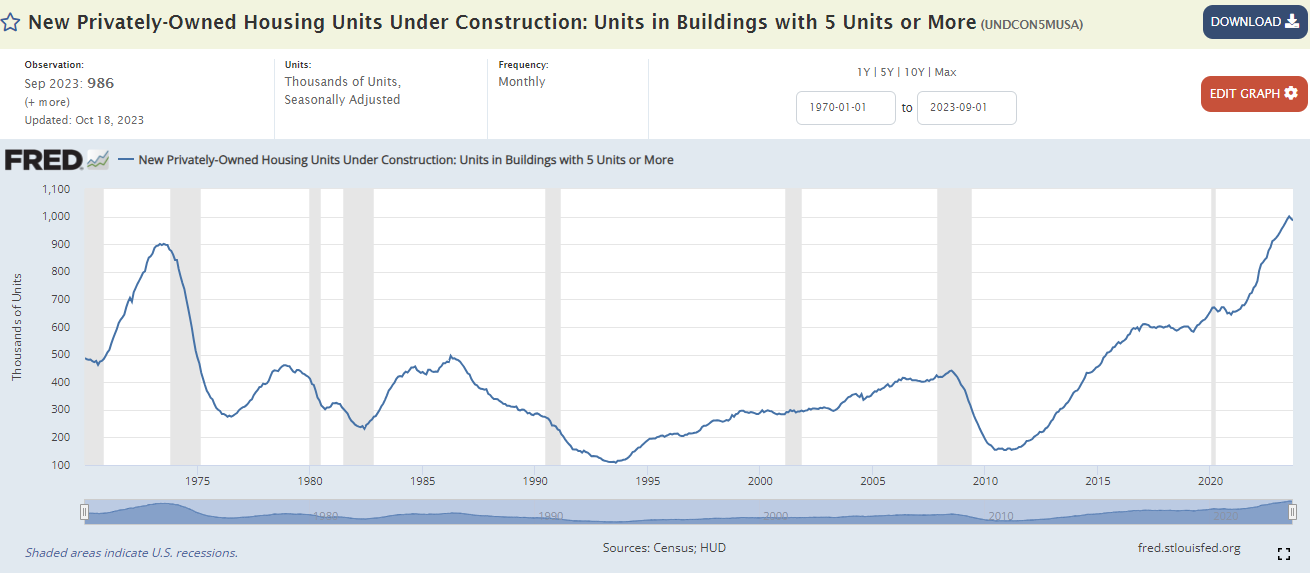

While there is a definite shortage of single family residences for sale, there is a lot of multi-family construction coming on line. You can see in the chart below that we have record numbers of apartment units under construction

Generally speaking multifamily cap rates are in the mid 5s, so we are at the point where interest rates are a problem. The big COVID-19 related rental inflation is over, and pricing is getting weaker, all while construction costs have been higher than expected. Multi-family commercial real estate might be the next shoe to drop in commercial real estate, especially in cities where pricing is now falling, like Phoenix, Las Vegas, etc.

With commercial real estate already having issues, the Fed is probably not in a position to keep increasing interest rates. Commercial real estate properties need to roll over maturing debt at higher rates, and the assumption that commercial real estate prices never go down is being blown up right now. If the buildings are underwater, the loans financing these properties should be underwater as well. The banks will end up owning a lot of these properties, and there are really not many buyers because no one wants to catch a falling knife.

I am hearing reports that multifamily deals are selling at a 25% discount to peak values in 2022, and the price deterioration over the past six weeks has accelerated. The developer’s equity is shot at this point and so they aren’t in the drivers seat when it comes to sales.

They always say the Fed hikes rates until it breaks something, and I think we might be at that point with commercial real estate. It will be interesting to see where properties trade when you have motivated sellers. The working assumption for the government has always been than you liquidate troubled bank assets when rates are low, which is not the case right now. Don’t forget that bank capital (Treasuries and MBS) are underwater, so the strength of the banking system isn’t as great as it may appear.

Unlike 2008, residential is fine while commercial is struggling. Home prices are beginning to fall in the overheated Sun Belt markets, but for the most part a dearth of homes for sale is keeping prices elevated. That said, we are seeing single family rental funds sell properties as the big gains in prices are behind us and the cost of financing them isn’t going to change much any time soon. Professional sellers of single family rental properties will go a long way towards freeing up inventory and hopefully addressing the supply / demand imbalance.

The consensus is growing that the Fed is done with rate hikes and now the question revolves around rate cuts. The Fed Funds futures start pricing in a meaningful chance of cuts by May. Morgan Stanley sees the first rate cut in June, while Goldman sees the first cut in Q4. If commercial real estate’s crash start causing problems at the banks, it will probably be sooner.

The week ahead will be dominated by the consumer price index on Tuesday and the Producer Price Index on Wednesday. We will also get retail sales and housing starts along with a slew of Fed speakers. The Street is looking for a 0.1% increase in the headline CPI and a 0.3% increase in the core rate (ex-food and energy).