The Weekly Tearsheet: GDP and the ECI. Are we looking at stagflation?

Last week had a lot of important economic data, and two reports stood out. First GDP grew at a paltry 1.1% in the first quarter of 2023. The increase in GDP was driven by consumer spending, while investment (particularly residential) was a drag. Residential construction has been a drag on GDP for the past 8 quarters in a row. In the first quarter of 2021, residential fixed investment came in at a seasonally-adjusted annual rate of $1.19 trillion. In the first quarter of 2023, it had fallen to a seasonally-adjusted annual rate of $570 billion.

It is interesting to juxtapose the decrease in housing construction with the fact that new apartment completions are the highest since the mid 1980s.

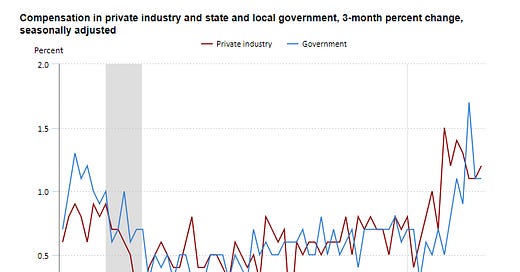

The employment cost index rose 1.2% quarter-over-quarter in March, which works out to be 4.8% annualized. The Fed is super-concerned about wage growth driving inflation going forward, especially in services ex-housing. In the report, it shows this is where the big growth is. We are seeing big increases in leisure / hospitality, transportation and nursing.

The Fed Funds futures are now pretty much centered around another 25 basis point hike at the May meeting this week and are assigning a roughly 25% chance of another 25 basis point hike in June. The market will be looking for language in the FOMC statement that signals that the Fed has hiked rates enough that it can take its foot off the brake and see how things shake out. I think the stock and bond markets will rally if we get the all-clear signal. If we get more of the “The Committee believes inflation is too high and ongoing increases in the Fed Funds rate will be necessary….” then I think we sell off.

The Fed is in somewhat of a pickle here, given that wage growth (especially in services) has become the big driver of inflation. The Fed has managed to take some starch out of the economy, but wage inflation running at 5% is not consistent with a 2% inflation target. With GDP growth running at 1% or so, the economy doesn’t have a tremendous amount of strength to withstand further tightening, and rate hikes generally affect the economy with a 6 - 9 month lag. The Fed is pretty close to stagflation territory, and there are strategists out there highlighting the risk that the Fed takes the Fed Funds rate to 6%.

Mortgage REIT AGNC Investment reported first quarter earnings last week. AGNC is the classic agency mortgage REIT, buying primarily specified pools which are expected to have slower prepay speeds than their peer group. After peaking in September of 2022, MBS spreads had been falling ever since. MBS spreads are the difference in return that a mortgage backed security investor requires over Treasuries of a similar maturity. When MBS spreads are “wide,” it means that MBS investors like AGNC Investment require the difference between a Treasury and a mortgage backed security to be a lot. When spreads are narrow, it is the opposite. Remember that MBS are Treasuries contain the same amount of credit risk - zero.

What determines MBS spreads? The biggest determinant of MBS spreads is interest rate volatility. While mortgage backed securities don’t have any credit risk, they have a lot of interest rate risk. When interest rates become volatile, MBS take a hit. Why is that?

The reason is based on options pricing theory. An option is a security that gives the holder the right (but not the obligation) to buy or sell an asset for a specified price for a specified period of time. In the case of mortgage backed securities, that option is the ability to prepay a mortgage without penalty. Options theory says that volatility is good for the option holder. So if volatility increases, the value of that option will increase.

Interest rate volatility started rising in early 2022 and has been elevated since, as the Fed started hiking rates. You can see that in the chart of the MOVE Index below, which can be thought of as a VIX for bonds. When the index is high, mortgage backed security prices decline. Since interest rates and bonds move in opposite directions, when mortgage backed securities drop in value, it means that mortgage rates went up.

AGNC Investment reported an increase in book value per share in the fourth quarter of 2022 as interest rate volatility subsided. As you can see in late March, the index shot up as a result of the Silicon Valley Bank situation. Luckily it looks like this spike was short-lived. I suspect that once the Fed signals that it is done with its tightening cycle, the MOVE Index will work its way lower.

The other issue for MBS is the fallout from the Silicon Valley Bank situation. The fear is that the regulators will dump the MBS portfolio onto the market. I suspect the FDIC is going to be mainly interested in getting top value for these assets, and the indications are so far that they are going to go slow with these assets.

Big picture, once the Fed gives the all-clear signal we will probably see interest rate volatility begin to wane, which will be supportive of MBS pricing. We could easily see mortgage rates in the mid-high 5% by the end of the year if the Fed decides to take a break after it hikes rates next week. This probably won’t make a massive difference in origination volume since it won’t trigger any sort of rate / term refinancing wave, but it probably will help on the affordability front and we could see some people decide to do a cash-out refinance in order to consolidate debt. We could see 2023 as the nadir for the mortgage industry and steady improvement from now on.