The Weekly Tearsheet: Is the government underestimating inflation?

One of the biggest head-scratchers over the past couple of years has been the resiliency of the US economy. In spite of 525 basis points in Fed tightening, the unemployment rate remains well below 4%. To put the tightening cycle into perspective, the last time the Fed Funds rate was in the current 5.25% - 5.5% range was early 2007, and before that in 1999. The tightening cycle we just went through was the most dramatic since Paul Volcker ran the Fed in the early 1980s.

In the past, tightening cycles have generally ended with the Fed causing a recession. In 2006-2007, the Fed blew up the residential real estate market, causing the Great Recession. In 1999, the Fed blew up the stock market bubble, causing a recession, albeit exacerbated by 9/11. In the mid-1990s, the Fed blew up the mortgage market, although the US avoided a recession. In the early 1980s, the Fed caused the worst recession since the Great Depression, causing the unemployment rate to hit 10.8%.

The Fed began liftoff in early 2022, and the last rate hike was in July of 2023, about 10 months ago. Yet, the unemployment rate has barely budged during that time. The Fed is vexed by its inability to slow down the economy, while the Biden Administration is tearing its hair out wondering why the economic numbers are good, but it gets no credit in the polls.

One of the main issues is that real (e.g. inflation-adjusted) interest rates are the driver of the economy, but the Fed doesn’t really have any ability to control that directly. The best it can do is control short-term nominal rates, and hope to impact real rates indirectly.

Since the Fed has to rely on government inflation numbers, it has to deal with the possibility that the government numbers are off. Or at a minimum the government numbers don’t match what consumers are seeing.

First of all, we have to discuss what inflation indices actually do and what they don’t do. Inflation indices are intended to measure overall prices spread out over the economy. They are not a cost-of-living index. They take what they think are a representative sample of expenditures and make all sorts of adjustment to the index to take into account technological improvements and shrinkage.

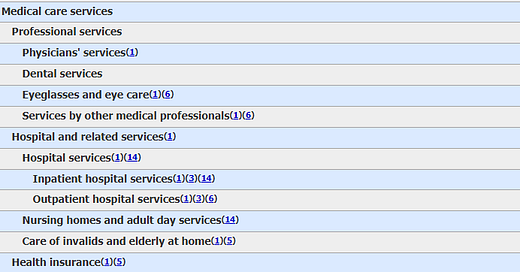

For example, the price of HDTVs have continued to fall, while the technology gets better and better. Cell phones are supposedly falling by double digits, but that can mean that the camera got better while the price stayed the same. Hedonic adjustments are intended to strip out some of the noise, but they can cause some interesting numbers. For example, were you aware that beginning in mid-2023, health insurance premiums started falling by double digits? In fact, in October of 2023, health insurance costs fell by 34%, while hospitalization costs rose 5.6% and other medical expenditures were up? In fact, health insurance in the latest CPI report supposedly fell 11.9%. Contrast that with the cost of the things health insurance pays for in the lines above. The first column is the weighting of that particular good, while the second column is the rate of inflation.

Do you believe health insurance costs are really down double digits when everything else is up? Do you believe health insurance costs fell by a third last year? The number doesn’t make sense, but who are you going to believe? Jared Bernstein or your lying checking account?

Other items like auto insurance are way up, along with shelter. Food has begun to stabilize after a torrid 3 year rise. But I suspect most people would disagree that inflation is running at 2.7%, regardless of what the BLS says. The latest Conference Board Consumer Confidence number sees inflationary expectations at 5.4% for the next year.

What if the government is underestimating inflation? That would explain stronger-than-expected GDP growth, since inflation is a deflator to GDP and if it is higher than advertised, GDP is lower than advertised. This would partially explain the “growth is great, so why is consumer confidence low?” It might turn out that growth isn’t so great - it just looks great because inflation is understated.

The other place this would play out is monetary policy. Fed policymakers remain surprised by the resilience of the economy in the face of a drastic tightening, and they should be. Historically, this dramatic of a rate hiking cycle would have pushed the economy into a recession. For most of this cycle, inflation has been higher than the Fed Funds rate, and the difference between the Fed fund rate and the inflation rate only turned positive late last year. If you use the Conference Board’s inflationary expectations of 5.4%, real interest rates are still 0%.

If the government is understating inflation, it is possible that real interest rates are lower than the Fed thinks, and monetary policy is not really restrictive. It would explain why inflation remains stubbornly high, and why consumers are feeling like the economy is bad, even when the official numbers say it is strong.