Week In Review: The Fed finally pivots

On the first day of Christmas, my Fed Chair gave to me, a dovish statement in a pear tree.

At the December Fed meeting, the Fed signaled that it is done raising rates, and is starting to pencil in rate cuts in 2024. This was music to the ears of the stock market, which promptly rallied on the news. The bond market also picked up, with the 10 year bond yield falling below 4% while the 2 year lost 20 basis points in yield to go out at 4.47%.

The dot plot forecasted more rate cuts in 2024 than it did in September, with the consensus falling from a 5.1% Fed Funds rate to a 4.6% Fed Funds rate. Below is a comparison between the September and December dot plots.

The Fed Funds futures see the December 2024 Fed Funds rate below 4%, in the 2.75% - 4.0% band. This would equate to six rate cuts. If the 10 year moves down parallel with the Fed Funds rate (a big if) and MBS spreads tighten we could be looking at mortgage rates in the 5s, which means 2024 might not be the horror story for the mortgage business that people were fearing in August and September.

What prompted the change in heart at the Fed? My guess the statement out of the President that the Fed should stop hiking rates. While the Fed is supposed to be non-political, that isn’t always reality, and I am sure the Central Bank would rather see Biden win in 2024 than Trump. Hence the marching orders for an election year easing cycle.

There was an interesting CBS News / YouGov poll showing that people are falling in love with bad old ideas like price controls. Basically a price control means that the government tells companies that they can charge no more than X for a good or service. For example, the government might tell Exxon that it cannot charge more than $6 a gallon for regular gasoline. The most common price control right now is rent control in some big metropolitan areas. Of course it does nothing to make rents cheaper overall in places like New York City. Price controls are usually sold as the solution to “corporate greed” and “price gouging” however all they really do is create shortages.

Of course the advocates of these sort of policies never mention that there is very little new under the sun when it comes to economic policy. Price controls have been tried before, and they usually led to the same thing: Deferred inflation and shortages.

FDR imposed wage and price controls during World War II, and once they were relaxed, we saw a burst of inflation in the late 1940s. Richard Nixon also imposed wage and price controls in 1971 and again in 1973, which did not make much of a dent in inflation. Due to the Arab Oil Embargo, the price of gasoline soared, which triggered price controls. The net result"? Gas Lines.

I guess housing would be the most likely target for price controls, and we are seeing big West Coast cities impose them. That said the big problem for housing is a lack of units, and price controls will do nothing to solve that problem. All they will do is make developers think twice about building where there is so much political uncertainty.

Housing prices are a political issue right now as it is probably behind what many call the Vibecession. The vibecession refers to the fact that the economy is pretty good if you look at unemployment and GDP, yet consumer sentiment is pretty dour. This is of particular concern for Democratic Party strategists who are tearing their hair out right now over the issue. Gasoline prices are not all that high at the moment, the price of goods has been falling for a while, and wages are increasing. The big sticking point is housing, with many younger voters seeing rising rent prices and unaffordable homes for sale. The government rolled out proposed legislation which would prohibit hedge funds and private equity from buying up single family properties. The number of units owned by hedge funds and private equity is so small in comparison to the housing stock in the US that this is nothing more than a “Washington feels your pain” signaling exercise.

I think part of the Fed’s plan to make voters happy is to start cutting rates in hopes of lowering mortgage rates. That is a much faster way to achieving affordability than waiting for new supply or wage increases. This does put the Fed in a bind as lowering interest rates will probably put upward pressure on prices. I think the Fed is hoping that as monetary policy uncertainty dissipates that we see mortgage backed security spreads return to normalcy. That could lower mortgage rates by 130 basis points if MBS spreads return to pre-global financial crisis levels. Any decrease in the 10 year yield would be gravy.

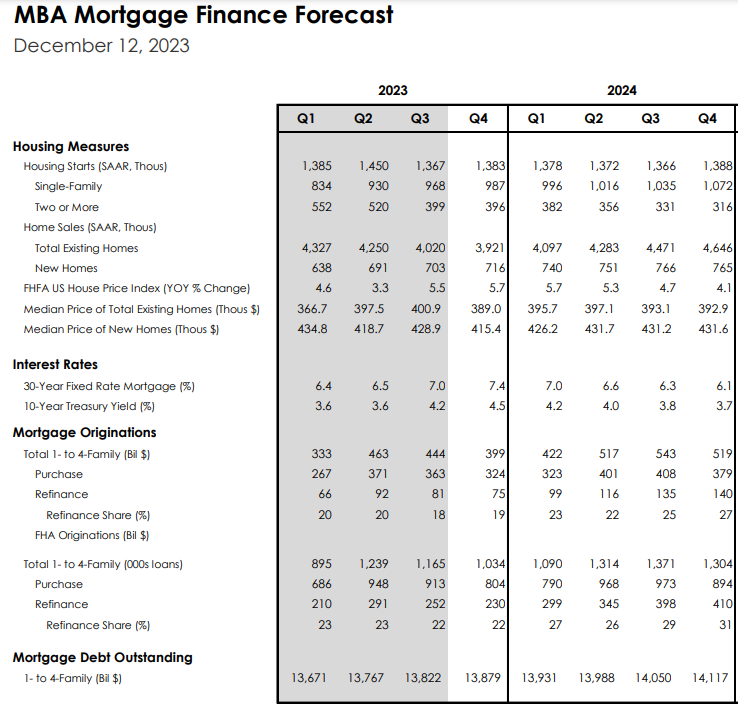

While a drop in mortgage rates to the low 5% area won’t trigger another refi boom, it will probably help alleviate the rate lock-in effect, which is discouraging people from selling their homes. The MBA updated their mortgage market forecast last week before the Fed decision. Suffice it to say there should be some upward revisions going forward.

Note that the 30 year fixed rate mortgage isn’t going to end 2023 at 7.4% - it is 6.7% currently and will probably work its way lower throughout the rest of the year. The 10 year Treasury is 3.93% instead of 4.5%. The MBA currently forecasts $2 trillion in origination in 2024 is probably going to turn out to be light. It certainly looks like Q423 will turn out to be the bottom of this mortgage cycle, and the Spring Selling Season (which starts unofficially around Super Bowl Sunday) might be better than people are fearing.