Week in Review: Trouble for the home building sector.

A statistic stuck out last week that summed up how lousy things are in housing right now. Homebuilder KB Home released their fourth quarter earnings and revenues were up 16%. Profit was up 30%. So what was the big deal?

The cancellation rate, which was 68%. Two thirds of home orders were cancelled. That is a lot. To put that number into perspective KB Home’s cancellation rate in 2008 was only 51%.

New construction timelines are quite long and rates rose rapidly over the second and third quarter. A lot of deals were signed when mortgage rates were 4%, and rates were 7% for much of October and November. Many borrowers no longer qualified for a mortgage at the higher rate, so the builder is stuck with a completed home and no buyer. This means the builders will probably be offering concessions in the Spring Selling Season to move the merchandise. The chart below puts into perspective just how fast rates rose last year.

KB said that it would focus on reducing backlog, which means it won’t be starting any new construction. That is a bearish take for a homebuilder. The Fed wanted a weaker housing market. They got it.

Of course if this is a trend we are looking at lower housing starts next year at least in the beginning. Housing is an early-stage cyclical, which means that it generally leads the economy out of a recession as the Fed cuts rates to stimulate the economy. With the Fed still focused on raising rates and cooling the economy, this will be a ways off, perhaps a 2024 event.

Wells announced it is exiting correspondent mortgage lending which accounted for about 44% of their mortgage production from October-December. Volume was down 32% compared to the third quarter and 70% from a year ago. This isn’t just Wells-specific as JP Morgan reported a similar decline. Over the past year, two of 2021’s top five originators have drastically scaled back operations (Loan Depot was the other). Capacity continues to get wrung out of the mortgage sector.

I have to imagine that numbers are going to be brutal for the big publicly-traded mortgage companies like Rocket and United Wholesale. United Wholesale is trading with a 10% dividend yield. UWM pays a $0.40 annual dividend and the Street thinks it will make $0.18 next year. I don’t see how that dividend doesn’t get cut or eliminated.

Last year independent mortgage bankers generally relied on servicing to offset declining production income last year. Often sales of servicing kept companies cash-flow positive. That game might be up. It seems like mortgage rates have probably peaked, and delinquencies have nowhere else to go but up. This means declining servicing values going forward.

Quick explanation on servicing: The mortgage servicer handles the administrative tasks of the mortgage on behalf of the investor. Think things like collecting payments, paying property taxes, etc. The servicer gets 0.25% of the mortgage balance as compensation. If the mortgage is $400,000, the servicer gets $1,000 a year. The right to perform that service is worth something and it gets capitalized on the balance sheet as an asset. Servicing is one of the few assets on the planet that increase in value as interest rates rise. Mortgage companies like this since it acts as a natural hedge for the business.

Mortgage servicing is a pretty illiquid asset as far as assets go. Not only that, everyone is pretty much always on the same side of the boat. Right now, Wells is looking to sell servicing, as are most smaller originators who want to raise cash. With servicing values declining as rates fall and delinquencies tick up, I could see a tough couple of quarters for the mortgage banks as servicing values decline while rates are still too high to stimulate refi activity.

Redfin reported that asking rents are beginning to fall, and the year-over-year increase of 4.8% was the lowest since mid-2021. Rents tend to lag home prices by about 21 months or so, which means rents should still be increasing if history is any guide. There is a seasonality aspect to rents, just like homebuilding. It will be interesting to see if rental appreciation picks up in the spring.

The biggest declines were in Minneapolis, Oklahoma City, and Phoenix. The biggest increases were in Salt Lake City, Raleigh and Indianapolis. I would have thought that rent increases / decreases would correlate strongly with local home price appreciation, but this looks like a pretty random group outside of Phoenix and Raleigh.

We had some good news on inflation last week with the Consumer Price Index falling 0.1% on a month-over-month basis. This was driven primarily by falling gasoline prices. The core rate (which strips out food and energy) did increase to 0.3% but this report does continue the trend of falling inflation. This was the third decline in CPI in a row.

Philly Fed President Patrick Harker said the Fed should slow the pace of hikes and get to 5% then pause. “I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed. In my view, hikes of 25 basis points will be appropriate going forward,”

This comports with the December dot plot. The dot plot is is a graphic demonstration of where each Fed member thinks the Fed Funds futures will be at the end of the year. Most of the votes (where the highlight is) think the Fed Funds target at the end of 2023 will be between 5% and 5.25%.

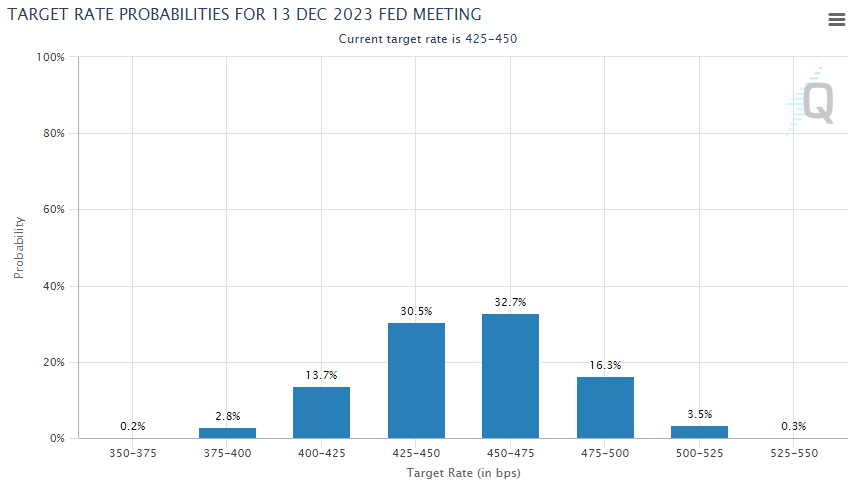

The Fed Funds futures aren’t buying this narrative, like at all. If you take the trading level of the various Fed Funds futures contracts, you can create a probability distribution which will lay out a market forecast. Here is the December 2023 probability distribution. Each bar represents a Fed Funds rate and the higher the bar, the more likely it is to happen. The Fed thinks that we will end the year with a target rate of 5% - 5.25%. The market’s handicapping? 3.5% chance. The second most likely Fed forecast is 5.25% - 5.5% and the market only sees a 0.3% chance. Data courtesy of the Chicago Mercantile Exchange.

If you take Harker’s forecast at face value, the Fed will hike 25 basis points in February, March, and May. The May Fed Funds futures have only a 1-in-3 chance of hitting 5% - 5.25%. The Fed Funds futures see the Fed hiking twice in 2023 and then cutting rates by 25 basis points towards the end of the year.

All of the sound bites I get from owners and CEOs aligns with your concern about new home creation. The bottom fell out of the purchase market in early October. The question now is whether or not it will recover in the spring buying season. Interest rates will definitely play a big factor. If home purchase doesn't pick up, I expect to see a lot of pressure on home prices.